Cisco, Nvidia, and the Economics of Tech Bubbles

What the dot-com buildout and the AI expansion reveal about state policy, investor hype, and the burdens of infrastructure

The “AI bubble” headlines aren’t going away—market swings and the deep financial entanglement of AI-related firms are now a daily fixture. Nearly two months ago, I tried to make sense of what this means for the broader U.S. economy in an article first published on September 29, 2025, thanks to Michael Spencer and AI Supremacy. You can read the original piece here.

Comparing Cisco and Nvidia

At the height of the dot-com boom, Cisco Systems briefly became the world’s most valuable company. Its routers and switches were seen as indispensable to the internet, and its stock rose nearly fortyfold in the 1990s. When the bubble burst, demand collapsed, carriers defaulted under massive debts, and Cisco’s market value plunged by almost 90%. Investors, pension funds, and workers bore the losses. Yet the infrastructure endured. The glut of idle “dark fiber” from the crash eventually lowered bandwidth costs and supported the growth of broadband and the cloud. Cisco’s trajectory revealed how speculative booms can destroy financial capital while leaving lasting material legacies and a powerful firm intact.

Two decades later, Nvidia occupies a comparable position in the artificial intelligence surge. Originally known for gaming chips, its GPUs became the essential hardware for training large AI models—controlling more than 98% of the AI accelerator market by 2023. By 2025 its valuation had climbed past $4 trillion (about 14% of U.S. GDP). As concerns about a bubble mounted, the financial press drew constant parallels to Cisco:

Financial Times, Aug 13, 2023: “Nvidia circa 2023, Cisco circa 2000”

Morningstar, December 7, 2023: “Nvidia 2023 vs. Cisco 1999: Will History Repeat?”

Financial Times (again), Feb 13 2024: “AI hype has echoes of the telecoms boom and bust”

Bloomberg, March 11, 2024: “Nvidia Vs. Cisco — A Bubble by Any Other Metric”

The Wall Street Journal, June 22, 2024: “Nvidia Is No Cisco, but It Is Getting Expensive”

Even the New York Times weighed in when Nvidia briefly surpassed Microsoft as the world’s most valuable company. Its rise has been driven by a twentyfold increase in data center revenues since 2020, fueled by orders from hyperscalers such as Microsoft, Amazon, Google, and Meta. Like Cisco in its era, Nvidia is cast as the “picks and shovels” of a digital gold rush. But its ascent has also been reinforced by state intervention—subsidies, export controls, and executive orders that frame AI infrastructure as a national security priority.

These comparisons are often invoked as warnings, but they also show how speculative bubbles are structured. The dot-com bust was not only the collapse of equity-funded start-ups; it was tied to the implosion of debt-laden telecom infrastructure, where Cisco played a central role. Today’s AI start-ups remain unprofitable (and may never be), yet Nvidia is highly profitable, its growth fueled not just by chips but by an unprecedented expansion of global infrastructure—data centers, energy, and land use—on a scale far larger than the fiber buildouts of the 1990s. If the AI bubble deflates, the financial fallout could be severe, and while Nvidia itself may weather the storm (as Cisco did), the systemic and ecological consequences could be even greater.

The sprawling Cisco campus in San Jose, CA, 2025. Photo by author.

Cisco and the Internet Buildout (1997–2002)

When people recall the dot-com bubble, they often think of quirky websites, speculative start-ups, and the collapse of a nascent internet culture. What receives less attention is the enormous infrastructure built during this period and the companies that supplied it. At the center stood Cisco Systems. By 2000, Cisco controlled more than 70% of the global market for high-performance networking equipment and, for a moment, was the most valuable company in the world, with a market capitalization exceeding half a trillion dollars (roughly 4% of U.S. GDP).

Cisco’s rise cannot be explained by private ingenuity alone; it was propelled by a broader political-economic shift. The Telecommunications Act of 1996, the first major overhaul of U.S. communications law in six decades, was marketed as deregulation but functioned as industrial policy. By privatizing the internet backbone and dismantling barriers between local and long-distance carriers, phone and cable companies, and telecom and internet services, it rewrote the rules to channel capital into fiber, switching, and long-haul infrastructure. The Act, presented as serving “the public interest,” opened new markets and spurred unprecedented private investment.1 Yet rather than fostering lasting competition, as its boosters claimed, it accelerated consolidation. Mergers among major telecommunications firms soon concentrated control of the internet’s backbone in the hands of a few corporations—an outcome industry insiders had anticipated. As Network World observed in 1995, “[u]ltimately, the Internet will boil down to a few big providers with bilateral agreements on how to interoperate, service and support one another’s networks.”2

Cisco quickly emerged as a major beneficiary. Its revenues surged as carriers expanded the internet backbone with debt-fueled investment, amplified by stock market enthusiasm. Between 1996 and 2001, U.S. carriers spent more than $500 billion on new networks, justified by the oft-repeated claim that internet traffic was doubling every hundred days. Though more myth than reality, this figure shaped expectations of limitless demand. Every new mile of fiber required routers and switches, and Cisco was the dominant supplier. Its reputation for reliability and innovation reinforced its position, while its advertising sought to make visible what was otherwise hidden infrastructure. A 2000 commercial evoked its tag line “empowering the internet generation,” depicting diverse global settings while asserting that virtually all internet traffic passed through Cisco’s systems.

Beneath this commanding position, however, lay fragility. Cisco outsourced much of its production to contract manufacturers such as Flextronics and relied heavily on component suppliers like Corning and JDS Uniphase. More critical still was its dependence on downstream carriers such as WorldCom, Global Crossing, and Qwest, which borrowed heavily to finance their buildouts. That wave of debt-financed bandwidth expansion most closely foreshadows today’s debt-financed push for computing power in AI data centers. As an article in Wired observed in 1998, “Qwest is operating under an if-you-build-it-they-will-come vision. Bandwidth restrictions, the company believes, have held back development of all manner of innovation.” Cisco reinforced this dynamic through vendor financing. Its subsidiary, Cisco Capital, extended billions of dollars in credit to telecom firms and start-ups, booking these loans as revenue even when buyers lacked cash. By 2000, roughly 10% of Cisco’s $20 billion revenues came from such financing. The practice inflated sales in the short term but tied Cisco’s fortunes to the solvency of customers already burdened by massive debt.

By 1999 it was clear to many insiders that dot-com start-ups were failing to generate sustainable revenue. Investor enthusiasm cooled, and debt-laden carriers saw growth slow. As lock-ups expired in early 2000, insiders across dot-com firms sold more than $43 billion in shares—twice the volume of the previous two years. The unraveling accelerated as WorldCom collapsed in an accounting scandal and Global Crossing, after laying vast undersea cables, went bankrupt. Within a few years more than twenty major telecom companies had failed, leaving the sector burdened with over a trillion dollars in unrecoverable debt. Cisco was pulled into the crisis, writing off nearly $900 million in bad loans by 2001.3 Its apparent boom had been underpinned by vendor financing and customer borrowing, a pattern resembling what economist Hyman Minsky described as the slide from hedge finance into speculative and Ponzi finance.4

The fallout was severe. Cisco announced a $2.2 billion inventory write-down and laid off 8,500 employees. Revenues stalled, and its share price fell from nearly $80 to under $10 by late 2002—an 88% decline. Investors lost hundreds of billions in market value. Pension and mutual funds that had treated Cisco as a core holding in tech-heavy indexes were hit hard. Vanguard’s U.S. Growth Fund saw its value fall sharply because of its large Cisco position. Vanguard’s U.S. Growth Fund dropped sharply, and public pension systems across the country reported weakened funded ratios. Years of litigation followed, with little real consequence or remedy. The collapse reverberated through the labor market as well, with more than half a million telecom jobs disappearing between 2001 and 2002.

Yet bubbles rarely leave only destruction. While financial capital was destroyed, fixed infrastructure remained.5 Billions had been sunk into fiber optic cables, much of it sitting idle as “dark fiber.” This apparent excess eventually drove down bandwidth costs for years, enabling broadband expansion, the rise of streaming, and the growth of cloud computing. The bust was both a disaster and a foundation. It also accelerated industry concentration. As smaller players liquidated, larger firms consolidated control of the digital economy’s backbone. Cisco anticipated this shift. In 2001, just after reporting heavy losses, it predicted that as these “networks of networks” (i.e. cloud) expanded, enterprises and service providers would standardize on only a handful of vendors. Two or three companies, it argued, would likely emerge as strategic partners.

The legacies of the dot-com boom and bust extended beyond unused cables. Many of today’s senior executives built their early careers at Cisco, carrying its practices into the next generation of firms. Cisco itself remains significant. Despite years of financialization through buybacks and acquisitions, by 2022 its revenues and workforce were more than double their 2001 levels. Its trajectory is illustrative of how speculative buildouts typically unfold: favorable policies create conditions for rapid expansion, narratives of exponential growth attract capital, suppliers scale to meet imagined demand, and collapse follows. Yet the wreckage leaves behind both financial losses and durable infrastructure that forms the basis for future growth. The dot-com and telecom crises fit this pattern, and their networks of networks prepared the ground for the cloud. By the early 2020s, a new story of limitless demand was already taking shape within the cloud—not around internet traffic, but artificial intelligence.

Nvidia and the AI Buildout (2021–2025)

In the span of just a few years, Nvidia transformed from a niche graphics and gaming company into the defining firm of the AI era. Breakthroughs in large language models in 2022 and 2023 suggested that the future of work, communication, and national security would depend on ever larger systems with unprecedented computing power. Once known mainly for gaming chips, Nvidia now supplied the GPUs that trained trillion-parameter models. By 2024 its market value topped $1 trillion, and by 2025 it surpassed $4 trillion, making the company the emblem of the AI boom.

Nvidia’s dominance in AI computing rests on a dual advantage. Its GPUs are optimized for the parallel processing needed to train massive models, outpacing competitors such as AMD and Intel. Equally important, the company developed CUDA, a programming framework that became the standard environment for machine learning. Because porting CUDA-based code to alternative hardware requires rewriting complex libraries, the framework locked developers into Nvidia’s ecosystem. Over time, Nvidia hired more software engineers than hardware designers, ensuring that its chips were paired with performance-enhancing tools. This ecosystem strategy gave the company an unrivaled moat. By 2023 Nvidia controlled more than 98% of the data center GPU market, with its Blackwell line alone accounting for two-thirds of quarterly data-center sales.

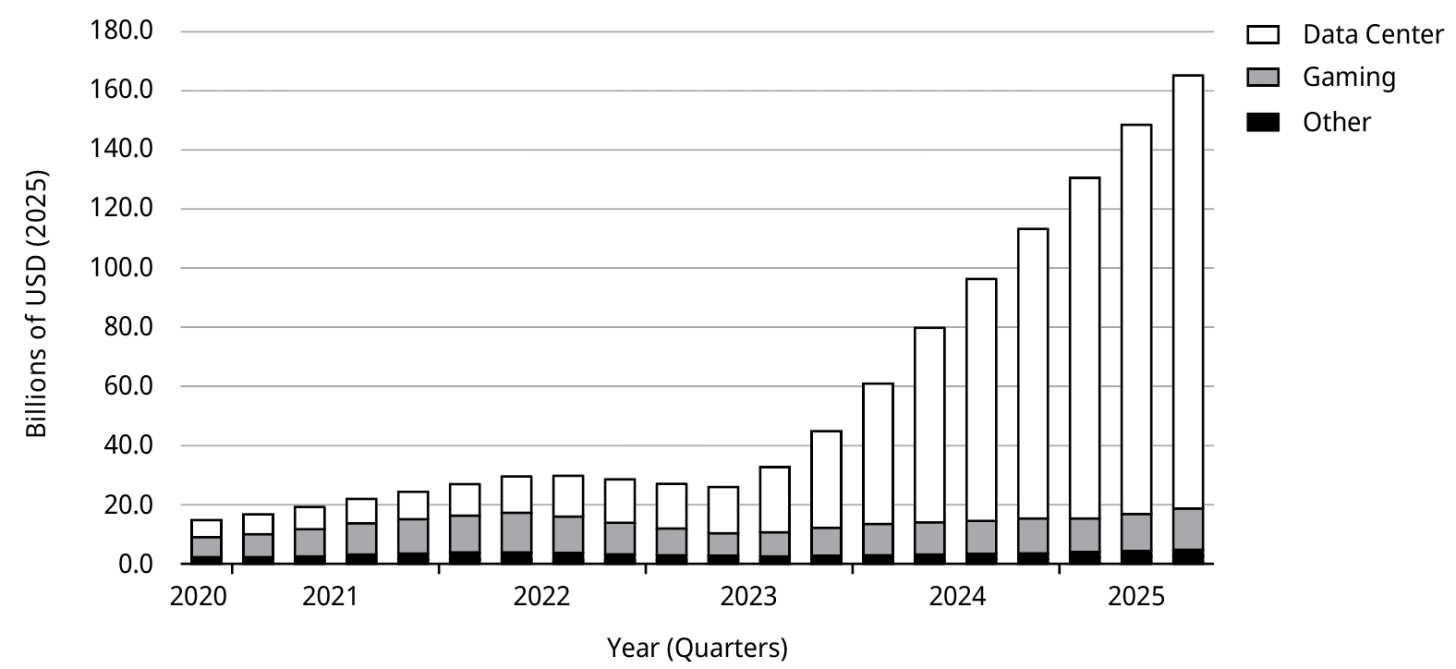

Data center revenue rose from under $6 billion per quarter in 2020 to more than $147 billion by Q3 2025, accounting for nearly 90% of total revenue. Gross margins hovered around 73%, with operating margins close to 60%. Free cash flow exceeded $25 billion each quarter, supporting stock buybacks of more than $60 billion. Yet this success rests on a narrow customer base. Nearly 40% of data center revenue came from just two buyers—widely believed to be Microsoft and Meta—and about half from hyperscalers overall. The remainder was buoyed by sovereign-backed projects in Europe, the Middle East, and Asia, along with U.S. government procurement.

Nvidia’s Revenue by Segment, 2020–2025

Industrial policy has once again reinforced this dominance, but in a different form. The CHIPS and Science Act directed billions in grants and loans toward domestic semiconductor research and fabrication, while recent executive actions under Trump 2.0 have declared AI infrastructure critical to competitiveness—fast-tracking new data centers and energy projects under a sweeping deregulatory agenda. The state is not simply enabling markets; it is reorganizing them, prioritizing the expansion of compute capacity through massive infrastructure investments. Where the Telecommunications Act of 1996 created markets for carriers and equipment vendors, today’s interventions restructure energy, land use, and permitting systems to accelerate the AI buildout.

The scale of capital expenditure is staggering. Nvidia executives estimate that global AI infrastructure spending could reach $3–4 trillion by the end of the decade. A single hyperscale data center, costing as much as $60 billion, could yield $35 billion in chip sales for Nvidia. Such figures fuel the conviction that the company can sustain valuations exceeding even those of Microsoft or Apple.

Nvidia has built a portfolio of investments in AI startups and infrastructure firms—including CoreWeave, Inflection AI, Mistral, AI21 Labs, Wayve, and Figure AI—aimed at extending its GPU dominance across the ecosystem. The strategy serves two purposes: first, to ensure these companies use Nvidia hardware, locking in chip demand; and second, to gain early insight into emerging workloads that inform future chip design and software platforms. Many of these firms, however, remain unprofitable and financially strained. CoreWeave, for example, reported nearly $1.9 billion in revenue in 2024 but posted losses of more than $860 million, weighed down by over $8 billion in debt and quarterly interest payments above $250 million. Growth is also slowing: after five quarters of triple-digit expansion in 2023 and 2024, revenue growth dropped to 56% year-over-year by mid-2025. Profitable applications beyond enterprise search and cloud services are still uncertain. Corporate deployments of generative AI tools show limited productivity gains, while governments and defense agencies increasingly appear to act as backstops.

The physical buildout of data centers is also magnifying these stakes. Training AI models requires enormous GPU clusters, often numbering in the hundreds of thousands, and the facilities that house them consume staggering amounts of electricity and water. Data centers are spreading into rural areas, industrial zones, and even former steel mill sites, reshaping landscapes in search of cheap power and available land. In Northern Virginia, home to the world’s largest concentration of data centers, grid operators warn of surging demand that could overwhelm the regional power system. In Arizona, cooling requirements have already sparked conflicts over water rights leading to successful resistance against data center construction.

While data centers could sit idle if demand slows, much like unused fiber-optic cables, their economics are far more resource-intensive. Unlike fiber, they require continuous inputs of electricity and cooling, often supported by new gas or nuclear plants built specifically for their needs. Utilities are already planning dozens of new gas facilities to meet projected demand, potentially locking in emissions for decades while passing costs on to average ratepayers. To accelerate construction, environmental protections are being rolled back, leaving communities with higher bills, more pollution, and contested land use. Nvidia’s success is thus tied directly to ecological and infrastructural burdens borne locally. These costs—actual and potential—could make the AI buildout even riskier than the telecom overbuild of the 1990s.

The Structure of High-tech Bubble Economies

Comparisons between the dot-com bubble and the current AI boom are proliferating, but they are often framed too narrowly as stories of firms and markets. What is at stake is the political economy of infrastructure—the ways states, regulations, and financial systems shape speculative expansion. In the late 1990s, start-up mania was only one part of the story. As the Cisco case shows, the more destabilizing crisis was the telecom crash, when carriers such as WorldCom and Global Crossing amassed nearly $1 trillion in debt to build fiber networks. This debt-fueled expansion was enabled by the Telecommunications Act of 1996, a deliberate act of techno-statecraft that privatized the internet backbone, reinforced monopoly power, and spurred speculative infrastructure investment. When carriers collapsed in 2001–2002, the shock rippled through banks, pension funds, equipment vendors, and workers. To speak only of a dot-com bubble obscures the entanglement of policy, finance, and infrastructure that made the downturn systemic.

Viewed through Nvidia’s rise, today’s AI frenzy carries familiar risks but on a far larger scale. America’s leading tech firms are expected to spend nearly $400 billion this year on AI infrastructure, with global investment projected to exceed $3 trillion by 2028. Independent GPU cloud providers like CoreWeave are financing rapid buildouts through large credit facilities, while Wall Street has created an $11 billion debt market using Nvidia chips as collateral. At the same time, AI labs are taking on “cloud debt” through long-term compute contracts that assume exponential demand will continue. Nvidia, like Cisco two decades ago, has become the indispensable bottleneck, its valuation sustained by the belief that computing demand will rise without limit. That narrative has unleashed staggering sums of capital, yet the downstream picture is far less secure. Chipmakers may appear to be the picks and shovels of this boom, but much of the activity in AI labs risks becoming a money trap. Even some optimists concede that, even if AI delivers its most ambitious promises, many investors are still likely to lose heavily.

The geopolitical landscape further distinguishes Nvidia’s moment from Cisco’s rise. Geopolitics today is not only about rivalry abroad but also domestic struggles over land and infrastructure. Data centers now cluster in rural areas, consuming vast amounts of energy, water, and land while sending their benefits to distant metropolitan centers and shareholders. This uneven geography of extraction and reward underscores how foreign policy is inseparable from domestic territorial politics. Cisco’s ascent took place during the optimism of the 1990s unipolar moment, when U.S. liberalization was promoted as a universal model just as the outsourcing of manufacturing was accelerating. States and municipalities competed with foreign sites for investment, while Washington assumed rivals would eventually converge. Nvidia’s growth, by contrast, unfolds under open rivalry with China, framed by techno-nationalism, export controls, and the treatment of infrastructure as a strategic asset. Local resistance to data center expansion is increasingly being overridden by state legislatures stripping municipalities of permitting powers—a domestic echo of securitized competition abroad.

It is important to emphasize that the Telecommunications Act of 1996 was not simply “deregulation,” but a state policy designed to shape markets. The liberalization of telecommunications was a form of techno-statecraft—a strategy to mobilize capital and export U.S. infrastructural control worldwide. Through the WTO’s Basic Telecommunications Agreement and a broader privatization agenda, Washington pressed other nations to dismantle state monopolies and open procurement to U.S. firms. Cisco’s equipment and American fiber-optic cable became the backbone of global connectivity in the late 1990s, embedding U.S. dominance into the architecture of the internet. This was industrial policy disguised as deregulation, reinforced by the Clinton administration’s 1997 Framework for Global Electronic Commerce, which codified minimal regulation, private-sector leadership, and open markets as global standards. It was an optimistic moment when the state extended markets outward, confident the world would follow.6

Nvidia’s success, by contrast, is bound up with defensive industrial policy aimed at maintaining a lead over China. The CHIPS and Science Act channels billions into semiconductor research and fabrication, while export controls restrict the sale of advanced GPUs abroad, effectively enrolling Nvidia into U.S. national security strategy. Under Trump, this logic has intensified in extractive form, with environmental safeguards rolled back, national energy emergencies declared, and public lands to be reclassified as AI-ready zones to fast-track data centers and power plants. The Department of Energy has even designated Cold War sites such as the Pantex Plant in Texas for rapid AI-energy buildouts. Executive orders essentially frame AI infrastructure as a matter of emergency and export strategy, casting oversight as an obstacle to competitiveness. Where Cisco once rode a wave of liberalization to global expansion, Nvidia advances in a climate of securitized competition, with industrial policy aimed less at opening markets than at securing them.

This entanglement also exposes Nvidia to the vulnerabilities of its supply chain. Its most advanced GPUs are designed in California but fabricated by Taiwan Semiconductor Manufacturing Company (TSMC) in Taiwan, tying the company’s fortunes to one of the world’s most volatile geopolitical flashpoints. Taiwan’s security now sits at the center of U.S.–China rivalry, and Nvidia’s reliance on TSMC raises the stakes of that confrontation. Pelosi’s 2022 visit to Taiwan, staged with TSMC leadership, underscored how semiconductor production links industrial and foreign policy. Nvidia’s role as one of TSMC’s largest customers highlights this mutual dependence, while TSMC’s new Arizona fab—backed by CHIPS Act funds—will produce Nvidia’s Blackwell chips. If Cisco’s global spread reflected Washington’s confidence in unchallenged dominance, Nvidia’s trajectory is tethered to a fragile security environment that makes its industrial strategy inseparable from high-stakes diplomacy.

The fragility lies not only in geopolitics but also in the concentration of demand. Cisco’s revenues depended on a few carriers whose bankruptcies rippled through equipment markets. Nvidia faces a similar risk: much of its income comes from a narrow set of hyperscalers, sovereign funds, and utilities. If their investments slow or prove uneconomical, the shock could cascade across the sector. Unlike fiber, which retained at least some value after the crash, GPUs depreciate quickly as new generations displace old ones. The result could be stranded assets in the form of overbuilt, energy-intensive data centers with few alternative uses.

The question is not whether the AI boom will end, but how its fallout will be managed. The stakes reach beyond investor portfolios to ecological strain, territorial conflict, and geopolitical crisis. Speculative technology booms are never just about exuberant markets; they reflect how states engineer demand, how narratives mobilize capital, and how infrastructures distribute risk. Cisco’s bust left financial wreckage but also a durable networked legacy. Nvidia’s moment may leave deeper systemic costs, with infrastructures that are harder to repurpose and more entangled in geopolitical tension.

If you’re here for more bubble, talk, please consider looking at my other articles on this:

References:

See Aufderheide, Patricia. Communications Policy and the Public Interest: The Telecommunications Act of 1996. Guilford Press, 1999.

Cooney, Michael, Adam Gaffin, and Ellen Messmer. “Internet Surge Strains Already Shaky Infrastructure: Who Will Manage the ’Net’s Commercialization?” Network World 12, no. 14 (April 3, 1995): 1; 67. Also see Couper, Elise A., John Hejkal, and Alexander L. Wolman. “Boom and Bust in Telecommunications.” Economic Quarterly 89, no. 4 (October 1, 2003): 1–24.

Starr, Paul. “The Great Telecom Implosion.” American Prospect, September 8, 2002. Available at: https://www.princeton.edu/~starr/articles/articles02/Starr-TelecomImplosion-9-02.htm.

Minsky, Hyman P. May 1992. “The Financial Instability Hypothesis.” Working Paper No. 74: 6–8.

Perez, Carlota. Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Cheltenham, England: Edward Elgar Publishing, 2002.

For more on the 1996 Act and its political economic developments, see McChesney, Robert W. Rich Media, Poor Democracy: Communication Politics in Dubious Times. Baltimore, MD: University of Illinois Press, 1999.

Nvidia sells the tools to make ai.

Carnegie sold the steel to make the railroads.

That’s where are in the bubble. It won’t pop until the railroad is finished. Which in terms of ai is rapid adoption of Waymo in U.S. cities.

It is the sole hardware that exists for their software programs and it is the only hardware people own that can adapt ai right now. The people buying home chargers, batteries, and EV’s was the first step of this bubble.

It’s why alphabet is the stock that’s going to hit 10t

This time around is more enmeshed in geopolitics and "national security". Washington's fear of China protects NVIDIA from overseas competition. Their dreams of robot armies give a plausible story for a backstop to a Capex binge that is otherwise clearly gluttonous.

What's not explained is how NVIDIA keeps monopoly-like margins, when Google, Microsoft, and Amazon are ready to squeeze them like a they've squeezed every other vendor. Those three remorseless competitors (especially) could care less about CUDA, in fact live by building out their own stacks at global scale. The remaining gatekeeper - TSMC - is already resentful that NVDA goes home with the money while they actually have the unique fab capability.